As a tenant, when you get a bill from the property manager or landlord, you often see a CAM fee. Sometimes, it’s included with the rent, and sometimes, it’s collected separately.

CAM fee is not applicable for single homes. It applies only to multi-tenancy buildings. This could be residential and commercial properties.

What is the CAM fee in real estate?

CAM stands for common area management. The cost for managing those common areas is the CAM fee.

Some examples of the common areas are as follows:

- Elevators

- Parking lots

- Yards

- Sidewalks

- Corridors

- Lobbies, etc.

How to calculate the CAM fees?

Property managers calculate the CAM fee for individual renters in two steps.

In the first step, they divide individual rent areas by the total rentable area. The previous result is multiplied by the total cost (estimated yearly cost) in the second step.

Not clear yet?

Don’t worry. Let me give you the formula and then a real example.

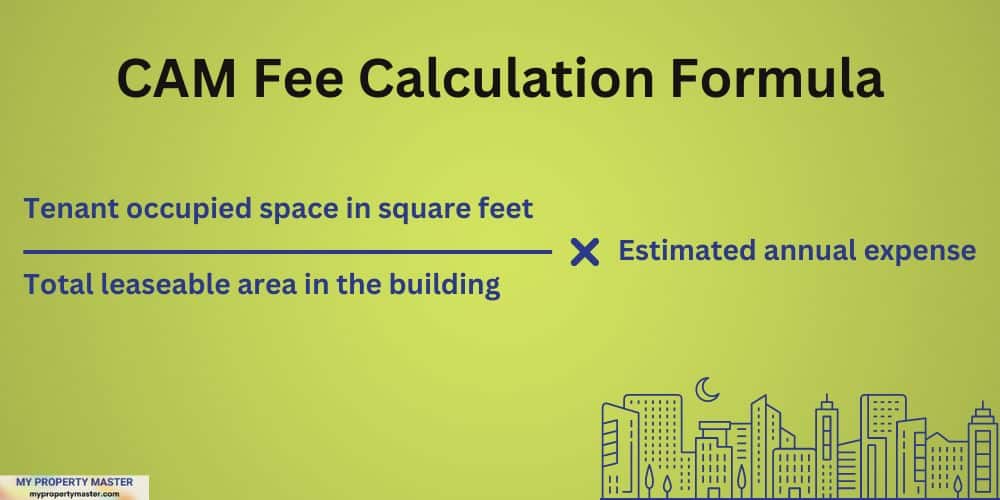

How is CAM calculated: Formula to calculate the CAM for individual tenant

(Tenant occupied space in square feet ÷ Total leaseable area in the building) × Estimated annual expense

Here, the total leaseable area does not include the common area. It’s just the leasable area.

The annual expense is estimated. The fee is collected monthly. Actual expense is adjusted in the last month of the year.

Think of a 5,000-square-foot building. Assume that it has a 2,000-square-foot common area. And your occupied rental space is 1200 square feet. Also, assume that the estimated CAM expense is $5,000 annually.

So the total leasable area is (5,000 – 2,000) = 3,000 square feet.

Now calculate your CAM fee based on the formula:

(1,200 ÷ 3,000) × $5,000 = $2,000

As mentioned earlier, the CAM fee is an estimation for a year. This $2,000 will be split into 12 months and collected from you monthly. Based on the above example, your monthly CAM fee will be ($2,000 ÷ 12) = $167.

So, you will pay a $167 CAM fee each month, and after the 11th month, the estimated yearly CAM fee will be finalized in an exact amount. If the estimation is greater or lower than the actual cost, this will be adjusted in the last month of the year.

What is the difference between CAM and NNN?

I explained the CAM above and showed you the formula and real examples. You should also know about the term before understanding its difference with the NNN.

NNN stands for triple net lease. It’s generally a commercial lease where the renters pay Taxes (N1), Insurance (N2), and Maintenance (N3) aside from their rents. You can learn more details on Legal Information Institute & Investopedia.

How is NNN calculated?

It is calculated very similarly to the CAM. If you have not checked the CAM calculation, go above and see it first.

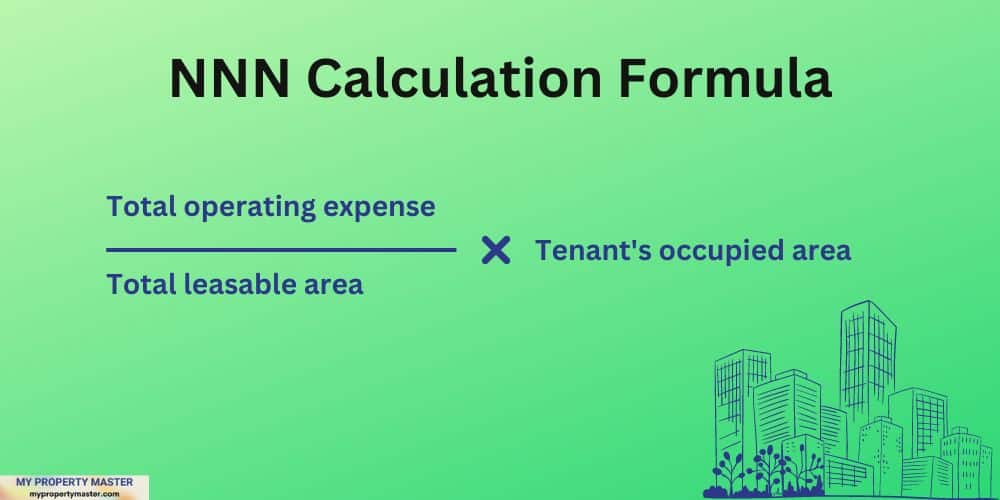

Anyway, here is the formula to calculate the NNN:

(Total operating expense ÷ Total leasable area) × Tenant’s occupied area

This will give you NNN for the whole year. But it’s collected monthly. So, you need to divide the result by 12.

The total operating expenses involve tax, insurance & maintenance (a yearly estimation). As mentioned earlier, the leasable area does not include the common area.

Main difference

The main difference between CAM and the NNN is the sectors of expenses. CAM only contains the expense for common area management. On the other hand, NNN contains tax, insurance & maintenance.

Otherwise, both are estimation of yearly costs, collected monthly & adjusted in the last month of the year.

Are CAM fees negotiable?

As I mentioned earlier, the CAM fee involves common area management. It’s collected from all renters equally based on the occupied space (square feet). This is why the CAM fee is not negotiable.

If a property manager takes a reduced CAM fee from one specific renter, the company ultimately has to reduce the fee for the rest of the renters. Otherwise, this will raise issues.

Related: How much does a property management company charge?

Wrap up

CAM fee is the expense related to the common area maintenance. It’s based on an individual tenant’s occupied space (square feet). At the start of the year, this is an estimation for the entire year. And the exact amount is adjusted in the last month of the year.

I explained a specific formula to calculate the CAM fees in this post.

NNN is also calculated very similarly to the CAM. Both CAM & NNN are not negotiable.