An owner statement is a document that summarizes the financial performance of a rental property for a specific period. It typically includes rental income, expenses, maintenance costs, and other relevant financial information. This statement allows the rental property owner to keep track of their investment and make informed decisions about managing the property in the future.

This statement is typically prepared by the property management company or landlord and is given to the property owner regularly, such as monthly or quarterly.

Let’s see what’s included, why this is important, and an example of this statement.

What is included in the owner statements?

The owner statement includes information on income, expenses, etc. Here are some common elements found in an owner statement:

- Rental Income: Details about the rental payments received from tenants, broken down by unit if multiple units are in the property.

- Expenses: All expenses associated with the property, such as management fees, maintenance costs, property taxes, insurance, utilities, etc.

- Vacancy and Lease Information: Information on the occupancy status of each unit, including details about lease renewals, new leases, and any vacant units.

- Repairs and Maintenance: A summary of repairs and maintenance work conducted on the property, along with associated costs.

- Reserve Funds: Any funds for future capital expenses or unexpected repairs.

- Net Income: The net income for the property is calculated by subtracting total expenses from the total rental income.

- Owner Distributions: If applicable, details about any funds distributed to the property owner, representing the profit after expenses.

- Outstanding Balances: Any outstanding balances or amounts owed by tenants.

Related: How much does a property management company charge?

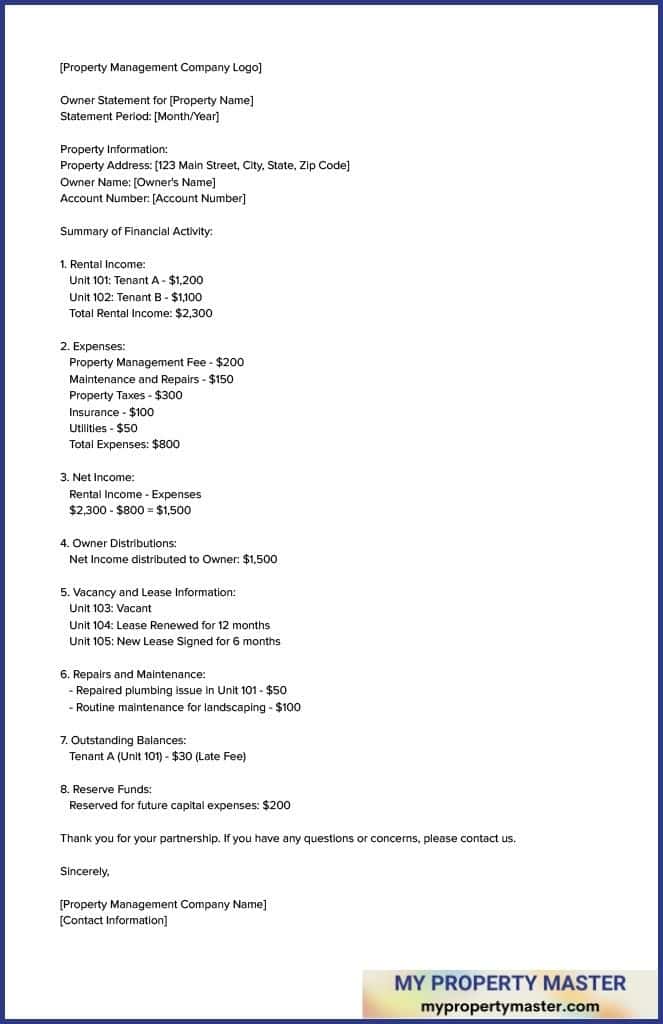

Owner statement example

Below is a simplified example of an owner statement for a rental property. Please note that the details can vary based on specific agreements and the complexity of the property management process. This example illustrates the typical components found in an owner statement.

This is a basic example, and in a real-world scenario, the statement may include more detailed information and additional categories based on the specific financial arrangements and agreements between the property owner and the property management company.

You can also download the sample in PDF format from the link below.

Download the example owner statement

Why are owner statements important?

Owner statements are essential for several reasons, providing property owners with valuable information and insights into their rental properties’ financial performance and overall management. Here are some key reasons why owner statements are essential:

Financial Visibility:

- Income Tracking: Owner statements detail rental income, including payments from tenants. It helps property owners understand their cash flow and monitor the timely receipt of rent payments.

- Expense Breakdown: The statements outline various expenses related to property management, such as maintenance, repairs, taxes, and insurance. This breakdown allows owners to track where their money is being spent.

Profitability Assessment:

- Net Income Calculation: Owner statements clearly show the property’s net income by subtracting total expenses from rental income. It’s a crucial metric for assessing the profitability of the investment.

- Expense Management:

- Identifying Trends: Owner statements help property owners identify trends in expenses over time. This information can be helpful for budgeting and cost management, allowing owners to make informed decisions about expenditures.

Occupancy and Lease Information:

- Vacancy Status: Owner statements provide information about the occupancy status of each unit, helping owners stay informed about vacancies and take proactive steps to address them.

- Lease Renewals: Details about lease renewals and new leases are included, allowing property owners to plan for rental income and occupancy changes.

Communication with Property Managers:

- Transparency: Owner statements create transparency in the landlord-property manager relationship. Property owners can review the details of financial transactions and expenses, fostering trust and accountability.

Decision Making:

- Informed Decision Making: Property owners can make informed decisions about the property with information from owner statements. It may include adjusting rent, addressing maintenance issues, or planning for future investments.

Tax Reporting:

- Tax Preparation: Owner statements provide a summarized record of income and expenses, simplifying the tax preparation process for property owners and their accountants.

Legal Compliance:

- Documentation: Owner statements serve as a documented record of financial transactions, which can be crucial for legal and regulatory compliance. This documentation may be necessary in case of audits or disputes.

Owner statements are crucial in helping property owners manage their investments effectively. They provide financial transparency and aid in decision-making.

Wrap up

Owner statements are invaluable tools for rental property owners, offering a comprehensive overview of their investment’s financial performance.

By detailing rental income, expenses, and crucial financial information, these statements empower property owners to make informed decisions about property management.

Transparency fosters trust in the landlord-property manager relationship, while the documented records aid in tax preparation and legal compliance.

Overall, owner statements are essential for enhancing financial visibility, assessing profitability, and facilitating sound decision-making in the dynamic realm of real estate investment.