Real estate investment has diverse investment opportunities. Investors can choose from various options based on their preferences, risk tolerance, and financial goals. And investing in rental properties is one of them.

As a property maintenance contractor, I have seen many investors who lost money and effort during the last few decades. I saw good and bad investments by working closely with investors, landlords, and commercial property owners.

Based on my practical experience, I will discuss a good return, how to calculate it, etc.

What is the ROI of a rental property?

ROI stands for “Return on Investment,” and the “good” return on rental property varies based on location, type, demand, local rules & regulations, job opportunities, natural environment, etc.

In the context of rental property investment, it is a measure of the profitability of the investment and is expressed as a percentage. ROI considers the total return relative to the total investment made in the property.

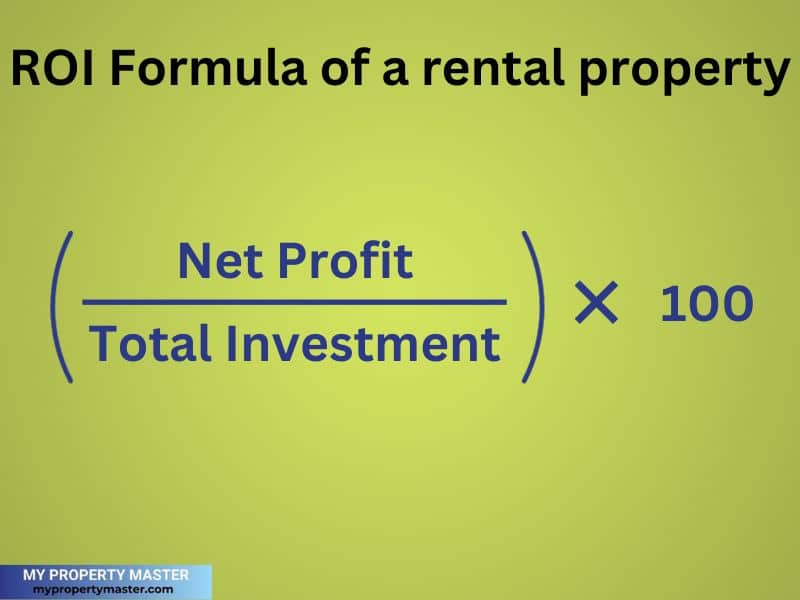

The ROI calculation formula for rental properties

The formula for ROI in real estate is as follows:

Net profit

Net Profit is the total income generated from the property minus all operating expenses, property management fees, mortgage payments, and other costs associated with the property.

Total Investment

Total Investment includes:

- The initial purchase price.

- Closing costs.

- Property improvement costs.

- Any other relevant expenses.

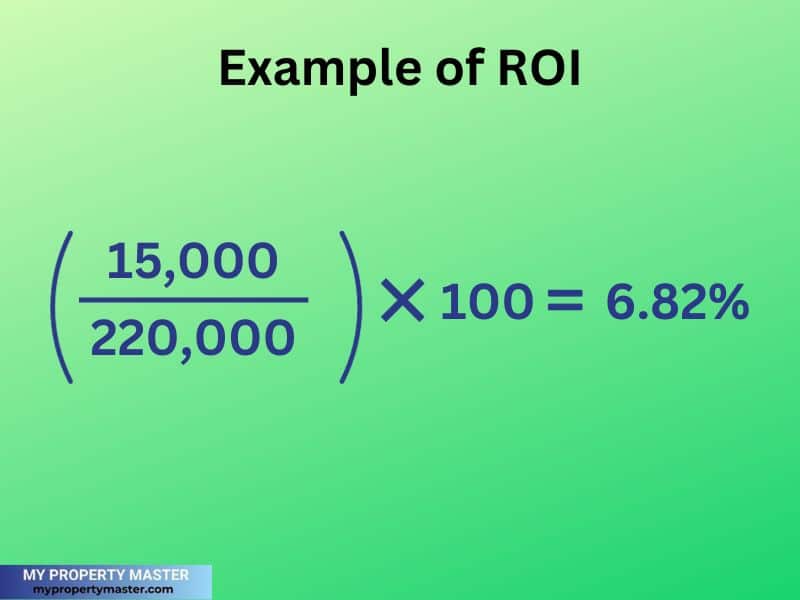

An example of ROI calculation

For example, if you purchase a rental property for $200,000, spend $20,000 on closing costs and improvements, and your net profit after expenses is $15,000 per year, the ROI would be calculated as follows:

In this example, the ROI is 6.82%. It’s important to note that ROI is just one of many metrics.

Investors often consider other factors, such as cash flow, appreciation, and market conditions, when assessing the overall viability of an investment.

Additionally, individual investment goals and risk tolerance can influence what constitutes a “good” ROI for a particular investor. Hopefully, it makes sense.

ROI metrics that investors use to evaluate the performance of a rental property

As I mentioned earlier, a good ROI depends on many things. However, there are a few standard metrics that investors use to evaluate the performance of a rental property:

Cap Rate (Capitalization Rate)

This is calculated by dividing NOI (net operating income) by its current market value.

A higher cap rate generally indicates a better return, but it’s also essential to consider other factors.

Formula: Cap Rate = (Net Operating Income / Property Value) * 100

Cash-on-Cash Return

This metric compares the annual pre-tax cash flow to the total cash investment (including down payment, closing costs, and renovations). It provides a percentage return on the actual cash invested.

Formula: Cash-on-Cash Return = (Annual Pre-Tax Cash Flow / Total Cash Investment) * 100

Return on Investment (ROI)

ROI considers the property’s total return, including cash flow and appreciation, relative to the total investment. It is expressed as a percentage.

Formula: ROI = (Net Profit / Total Investment) * 100

Gross Rental Yield

This is a simple calculation of the property’s annual rental income relative to its purchase price. It’s expressed as a percentage.

Formula: Gross Rental Yield = (Annual Rental Income / Property Value) * 100

Frequently asked questions

A good ROI is often considered in the 8-12% range for rental properties. It also depends on other factors that I mentioned in this article.

The 1% rule is a general guideline used by real estate investors to evaluate a rental property’s potential profitability quickly.

It states that a rental property will likely be a good investment if the monthly rental income is 1% or higher of its total acquisition cost.

This rule is a simplified metric to help investors quickly screen properties and assess their potential cash flow.

The formula for the 1% rule is as follows:

Monthly Rental Income ≥ 0.01 × Total Acquisition CostMonthly Rental Income ≥ 0.01 × Total Acquisition Cost

Here, the total acquisition cost includes not only the purchase price of the property but also other acquisition-related expenses, such as closing costs and any initial repairs or renovations.

For example, if a real estate investor purchases a property for $200,000, the 1% rule would suggest that the monthly rental income should be at least 0.01 \times 200,000 = $2,000 for the property to meet the guideline potentially.

Conclusion

As a property maintenance contractor, I wrote this article based on practical experiences. It explores the critical aspect of Return on Investment (ROI) in the context of rental properties.

It provides a comprehensive formula for calculating ROI. Also, it explains key metrics such as cap rate, cash-on-cash return, return on investment (ROI), and gross rental yield, which guide investors in evaluating the performance of a rental property.

The 1% rule is also introduced as a quick screening tool for assessing a property’s potential profitability based on monthly rental income relative to total acquisition cost.

Ultimately, a good ROI for rental properties is often considered to fall within the 8-12% range. However, individual goals and risk tolerance play a crucial role in determining what constitutes a favorable return.